It feels like we were just sharing with you the successes of the first quarter, when unexpectedly a new one arrived. Nevertheless, we did not waste any time and are ready to share with you pleasant news and updates.

In the second quarter, our specialists worked really hard. Now the MC Pay app has become even more user-friendly than ever before. To give you an in-depth look at the changes to the app and our plans, we asked our CTO Egor Nedbailo about the future of MC Pay.

Table of Contents

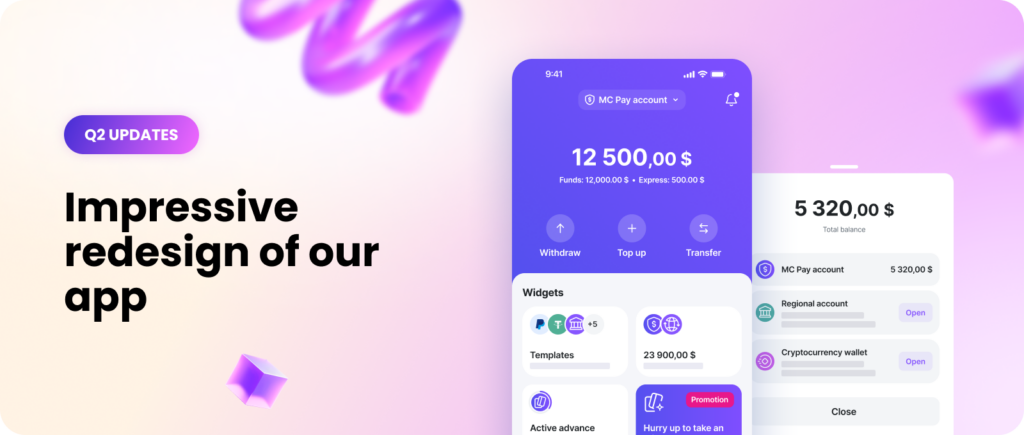

First of all, we’ve adapted the MC Pay app for large screens. Previously, the app simply stretched to fit the big screen. Now all blocks, sizes and indents are calculated using a formula and displayed proportionally to each other.

Second of all, there are some changes in “Balance”. In the previous version of MC Pay, this was a screen with a list of all accounts, but experience shows that people mainly use only one account, so switching accounts was moved into a block with a general MC Pay balance, neatly located next to the templates.

Also, considering the new block format, we have collected all the important things literally on one screen, concentrating all the user’s attention on fintech products and interaction with them.

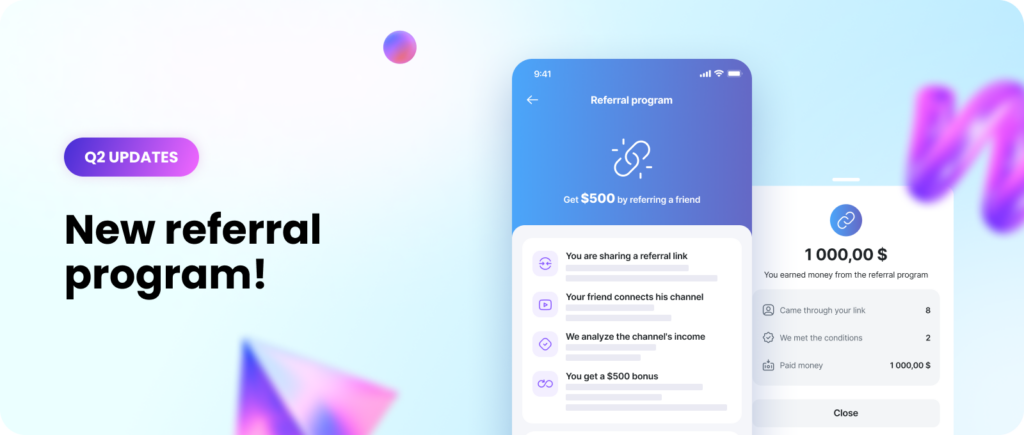

Each user will have a unique link generated, via which they can invite other creators to the network. After successfully connecting a channel with an income of $3,000 or more, the user who invited this channel will get a $500 bonus.

To receive the bonus, the user must meet the following conditions:

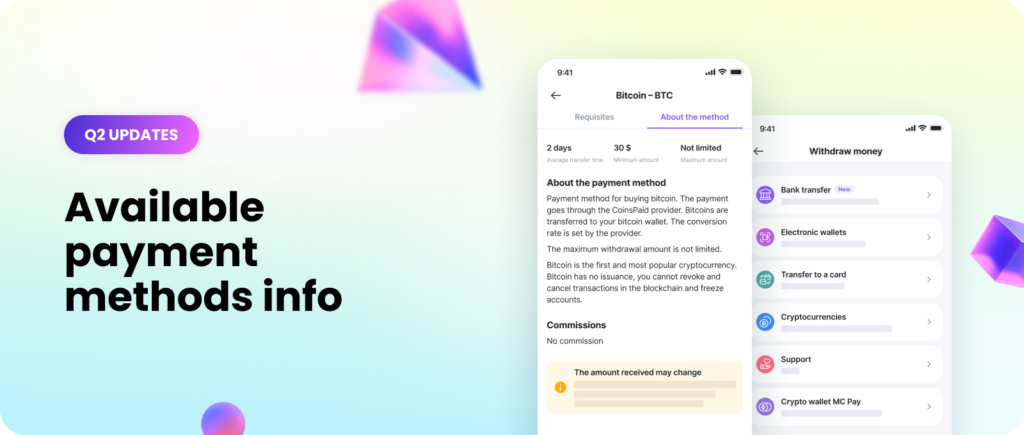

Now, users who have passed the KYC and have a balance of </= $0 will see payment methods and will be able to view information about them while clicking on the “Withdraw” button. However, the “Details” tab will still be limited.

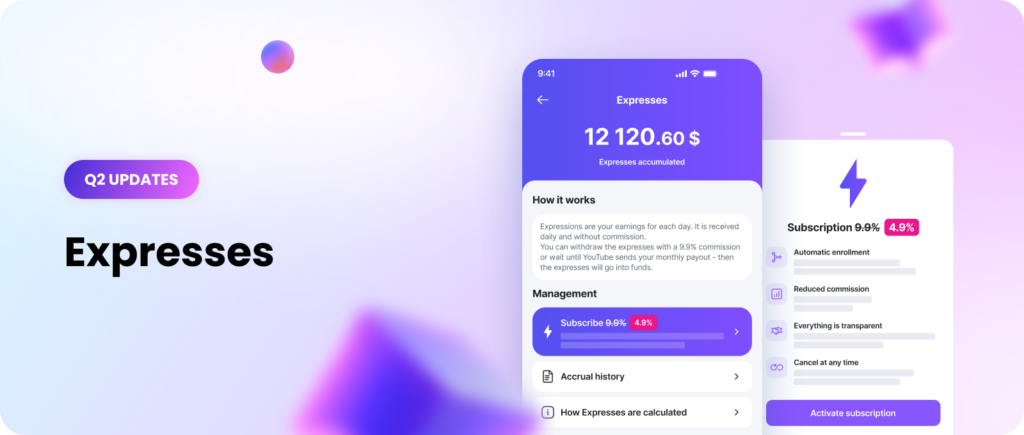

We simplified the naming, reduced everything to Expresses, which are already used in our work. Now it’s both the name of the feature and the old Credits. We rewrote the interface texts accordingly.

The feature is now called Expresses. You can simply enable Expresses, or you can enable a subscription.

Despite MC Pay’s grand updates, we are always in the process of transformation. We always think big, so we immediately set ourselves ambitious goals for the next quarter. We asked our CTO Egor Nedbailo about MC Pay’s development plans for Q3:

“We’re setting ourselves a lot of really cool product challenges in the new quarter. Among them are:

To increase the speed of processing and automatic confirmation of transactions, the system will work on “Auto-confirmation of transactions”.

The system will check the transaction for fulfillment of specific conditions and if all items are fulfilled, the transaction will be carried out in automatic mode without manual intervention. It means that this feature will work much faster!

The user will be able to activate the subscription to “Early Payouts” and customize the payment method to which the auto withdrawal will be created. Now you will not need to log in to the product every time, as the withdrawal transaction will be created automatically.

In the near future we plan to create a selection of templates (saved transfer details) on the output screen, which will greatly simplify the use of the app.

Since we are a public company that has been successfully holding on to the market for a year now, we are used to sharing our long-term plans. As our CTO Egor Nedbailo says : “We hope to have a release of our payment system soon. Despite the challenges, we are already preparing for this incredible change.”

And our experts also shared that MC Pay plans to expand “Quick Payout” not only in euros, but also in other popular world currencies.

We’re sure that you’re as excited about the MC Pay updates as we are. In any case, we’ll have a chance to tell you about new features very soon. In the meantime, download MC Pay in the App Store and Google Play and get acquainted with the future of fintech now.

Best regards,

Mediacube Team

Comments